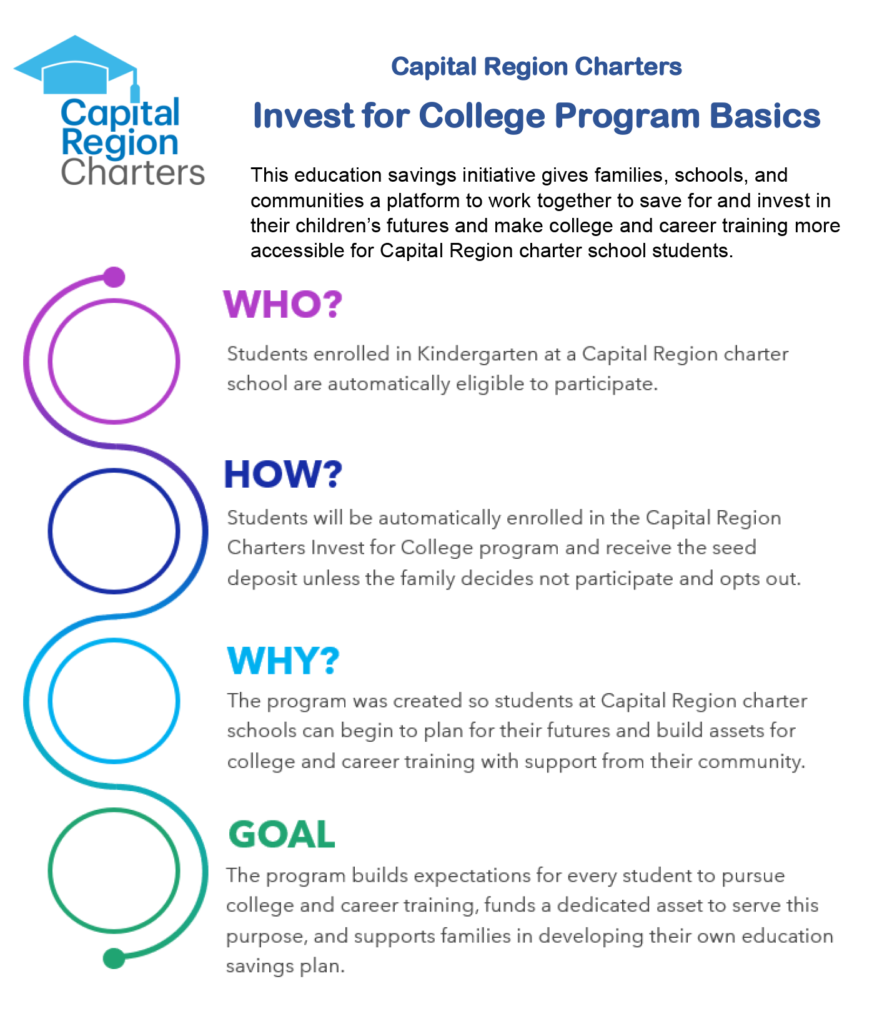

INVEST FOR COLLEGE PROGRAM

What is the Invest for College program?

The Capital Region Charters Invest for College program is a pilot initiative working to increase the accessibility of college and career training for public charter school students, regardless of income. Every kindergarten student enrolled in a Capital Region charter school automatically receives a $100 scholarship deposit in an Invest for College account on their behalf unless their parent or guardian “opts out” of the program. Families have the opportunity to earn additional scholarship funds by taking certain savings actions throughout the year. Invest for College scholarship funds are invested in New York’s 529 College Saving Program Direct Plan in an account that is funded, owned, and managed by the Brighter Choice Foundation, a local nonprofit organization, on behalf of participating students. Funds can only be used for qualified higher education expenses by the participating student. The account is entirely free to participating families, and parents will never be required to deposit any money. There is no family income test to participate. Capital Region Charters Invest for College allows parents, families, friends, schools, communities, and businesses to work together to build assets for and expectations of educational success for each student.

Why was the Invest for College program created?

It can be difficult to save for a child’s educational future. For many families, sending their children to college may seem financially out of reach. The Brighter Choice Foundation started the Invest for College program to help and support families to begin saving and planning for college and career training from their child’s very first days of school. Research shows that children with a college savings account of even just $500 are three times more likely to enroll in college and more than four times more likely to graduate.

Who is eligible to participate in the program?

Every child newly enrolling as a kindergarten student in a Capital Region charter school in the 2023-24 school year can participate in the Invest for College program. Qualifying students must attend a participating school for at least 60 days to be enrolled in the program.

How do I participate?

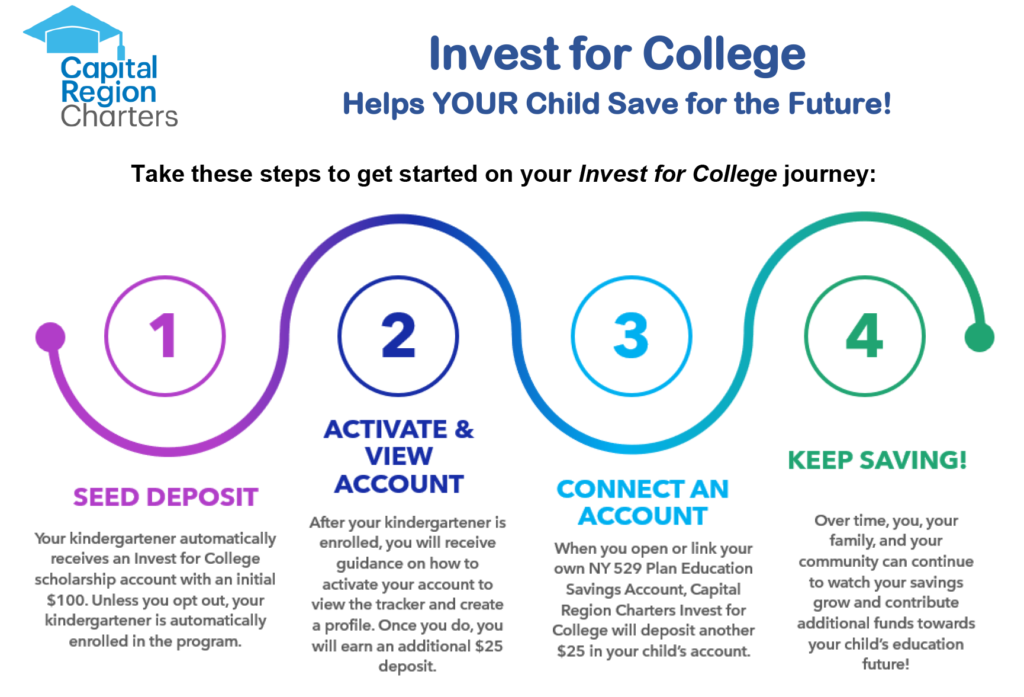

You do not need to do anything other than enroll your kindergartener at a participating charter school! As long as you do not opt out of the program and your child remains enrolled in the school for at least 60 days, your child will be automatically enrolled and an Invest for College account will be created in your child’s name. Parents will receive additional program information after their child’s Invest for College account is established, including how to activate the online Savings Tracker platform to view the account funds and monitor progress over time, and how to qualify for additional incentive and reward deposits into their child’s account.

What if I don’t want to participate?

If you do not want to participate in the Invest for College program, just tell your school and you will be provided an official opt-out form. Simply sign the form and return it to the school by November 1, 2023. Taking this action means your child will not receive a scholarship account, the $100 investment, or future funds.

Can I cancel my child’s participation?

Yes, you may cancel your child’s participation at any time after being enrolled in the Invest for College program. Just notify your child’s school in writing of your decision to withdraw. Scholarship accounts created for a child will be forfeited upon a family’s withdrawal from the program.

How does the “scholarship” piece of the program work?

Once your child is enrolled in the program, the Brighter Choice Foundation will create an Invest for College scholarship account and automatically allocate $100 toward your child’s educational future. Over time, Invest for College will offer opportunities for your family to earn more money to be deposited into your child’s scholarship account. Brighter Choice Foundation owns and manages the scholarship funds on behalf of participating students, and invests the funds in the NY 529 Direct Plan, a type of investment account specifically designed to help save for college and career training expenses. As an investment, these accounts can gain or lose value over time depending on the activity of the financial markets and the performance of the investment. As the parent or guardian of an eligible child, you will receive notification when your child’s Invest for College account is created, information about how to activate and monitor the account, and tips on how to earn additional investments into the account. While parents cannot make deposits directly to an Invest for College account, they are encouraged to open a similar college savings account that they own for the benefit of their child and connect that to their child’s Invest for College account.

How does the “savings” piece of the program work?

After your child receives their Invest for College scholarship account, you will receive more information on how to create a college and career savings plan that is right for you and your family. To build on the money invested for your child in their scholarship account, you can open and connect a NY 529 Plan account that you own that will also help you and your child save and invest for two-year and four-year colleges, trade schools, and qualifying apprenticeship programs. Unlike the Invest for College scholarship account that is owned and managed by Brighter Choice Foundation for your child’s future education, your family owns any connected NY 529 Plan account that you may choose to create. You, your relatives, and your friends can contribute directly to this account. Depending on which type of savings and investment account you choose, you may be able to track your own savings balance along with your child’s scholarship account online through the Invest for College Savings Tracker program.

What can Invest for College funds be used for? Are there any restrictions?

Money in a child’s Invest for College scholarship account is invested in the NY 529 Direct Plan and can be used for a variety of higher education expenses, such as tuition, fees, room and board, textbooks, and more. In addition to costs at traditional 4-year colleges and universities, funds in the account can be used to pay for qualified higher education expenses at other types of eligible institutions such as community colleges, trade and vocational schools, eligible apprenticeship programs, and online degree programs. Visit nysaves.org for a full list of qualifying higher education expenses.

What information about my child and me is shared with the program when we participate?

To properly establish the Invest for College scholarship account, the Brighter Choice Foundation will receive the following information from the participating charter school for every participating student: student and parent identification numbers that are unique to the program; student’s full name; student’s birth date; student’s home address; student’s home phone number; student’s school name; information about a transfers made to another school, if any. The Brighter Choice Foundation also will receive the following information for parents or guardians of a participating student: parent/guardian full name; parent/guardian email address; parent/guardian contact phone number. This is similar information to what is submitted when you enroll your child in school. The Brighter Choice Foundation follows strict privacy and confidentiality guidelines for all family information. If you have any questions or concerns about this information sharing, please discuss them with the program representative or other officials at your child’s school.

Download the above Invest for College FAQ as a printable PDF

Download the above Invest for College Basics flyer as a printable PDF

Download the above Invest for College Journey flyer as a printable PDF

Invest for College is a scholarship and savings program administered by the Brighter Choice Foundation, a nonprofit organization established to transform and improve the K-12 public education landscape in the Capital District. The Brighter Choice Foundation is neither affiliated with, nor an authorized distributor of, New York’s 529 College Savings Program and does not solicit investments or provide investment advice.